Endre Rangnes becomes the new CEO at Finans2

27 Oct 2021, 4:47 GMT

On Friday, Jon Harald Nordbrekken announced that Bank2 has entered into an agreement with Aleph Capital Partners to acquire Finans2.

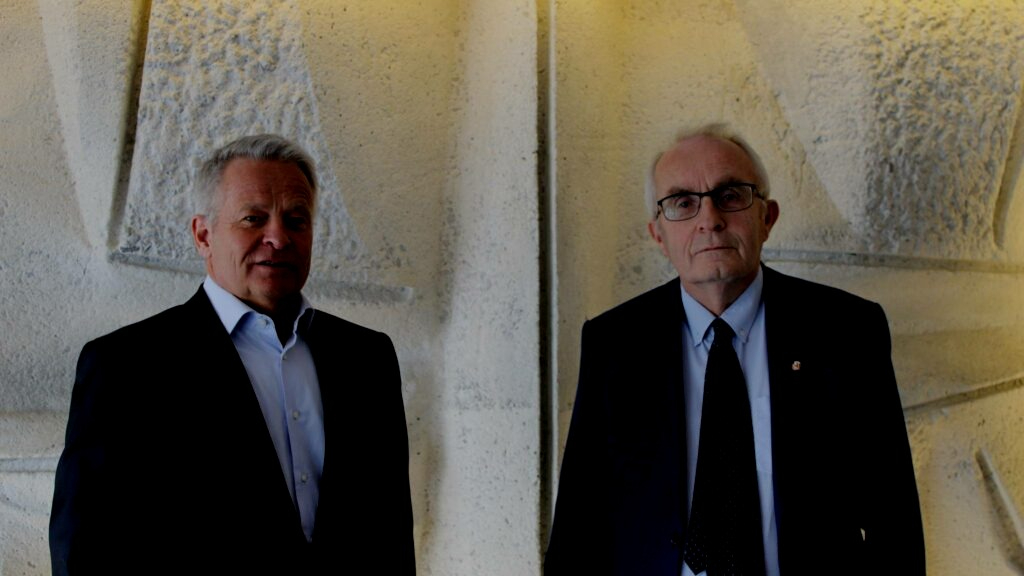

Endre Rangnes becomes the new CEO at Finans2, the debt collection company currently managed by Jon Harald Nordbrekken

On Friday, Jon Harald Nordbrekken announced that Bank2 has entered into an agreement with Aleph Capital Partners to acquire Finans2. As part of the transaction, Finans2 will purchase the bank’s portfolio of non-performing loans.

Finans2 will be managed by CEO Endre Rangnes and a new management team gathered under his leadership. Jon Harald Nordbrekken will become the Chairman.

Endre`s new leadership role gives him the opportunity to get back at Axactor after he was fired from the company one year ago.

“I was contacted by Aleph Capital and asked if I wanted to join their new platform as CEO. I could not turn down the offer, and I look forward to contributing with my knowledge and drive to establish Finans2 as a new competitor in the credit management industry”, says Rangnes to Finansavisen.

“In Europe there are large volumes of non-performing portfolios to be sold. Not all players have equal access to capital, which has created an imbalance in the marked. As such, our timing is very good. The prices are going down, and we have over NOK 10 billion to spend”.

– ENDRE RANGNES, CEO

Establishes a new competitor

How do you think your previous employer reacts to the news about you establishing a new competitor?

“I must admit that I haven’t thought about that. We are entering into a large market. As such, I believe there is room for another competitor”, says Rangnes.

When Rangnes started Axactor in 2015, he came from the position as CEO at Lindorff. At the time, Axactor recruited many of Lindorff’s employees. Instead of shareholders fearing that the same would happen this time around, the Axactor shares got a solid boost on the Oslo Stock Exchange. B2Holding also experienced the same boost. Jon Harald Nordbrekken is the third largest shareholder.

On Friday, both shares increased with 4,4 percent.

Aleph Capital pays NOK 400 million for an 80 percent ownership share in Finans2. Nordbrekken and Rangnes enters the company with a total of NOK 50 million, giving them 20 percent ownership. In addition, Aleph Capital Partners will contribute with NOK 4 billion to create a leading pan-European non-performing loan platform and debt collection agency. With additional loans, Finans2 will have more than NOK 10 billion to trade non-performing portfolios.

“We will work together with banks and financial institutions to buy non-performing portfolios. The ambition is to use Finans2 as a starting point for further expansion in the European market”, says Rangnes.

“Bullmarket”

Several analysts predict that there will be a bull market for the debt collection industry after the pandemic.

– In Europe there are large volumes of non-performing portfolios to be sold. Not all players have equal access to capital, which has created an imbalance in the marked. As such, our timing is very good. The prices are going down, and we have over NOK 10 billion to spend, says Rangnes.

However, Rangnes will not reveal which countries Finans2 will enter first. His only comment is that they are relatively large markets in Europe with a good volume of non-performing portfolios.

“Our aim is to rapidly establish our business and enter seven countries within the next six to twelve months. Aleph Capital has a very good network of financial institutions in several European countries. Finans2 already have offices in Denmark and Sweden”, says Rangnes. To Finansavisen`s knowledge, Finland will be one of the first countries the company will enter. This entry fits Nordbrekken`s profile. All of his companies have invested in Finland at an early stage.

Experienced management team

“We are establishing a competitor to both Axactor and B2Holding”, says Nordbrekken, and continues:

“The credit management market is huge and will grow in the future. As such, it is not a problem that we are establishing a new competitor”.

Nordbrekken has a value of NOK 215 million in B2Holding and has not sold a share in the company he once established. This week, several major shareholders, such as Stenshagen Invest and Rasmussen Group, acquired more shares in the company.

Nordbrekken and Rangnes may be characterized as some of the most experienced stakeholders in the industry.

Jon Harald Nordbrekken

- Has worked in debt collection industry since 1980’s

- Chairman of Zolva Group

- Founder of Finans2

- Founder and Chairman of Bank2

- Founder and Chairman of B2Holding

- Founder of Aktiv Kapital

- CEO of Intrum Justitia Norway

Endre Rangnes

“In this industry you need to work with the best people. We are searching for the most talented people, and with our network I am sure we will attract the right minds”, says Rangnes.

- Founder and CEO of Zolva Group

- Founder and Group CEO of Axactor

- Board Member of TietoEVRY

- CEO of Lindorff Group

- General Manager of IBM Norway

No plans to sell his stocks in Axactor

Rangnes is still the fourth largest shareholder in Axactor. However, he will not sell his shares, even though Axactor is one of Finans2`s competitors.

“The market value of Axactor does not reflect the underlying values in the market. I think the entire industry will be revalued, due to large volumes of debt portfolios coming on the market soon”, says Rangnes.

NEWSLETTER

Nov 21

There are scam messages in Zolva’s name

Scam messages have been sent at least by e-mail and demand to pay the debt.

Aug 25

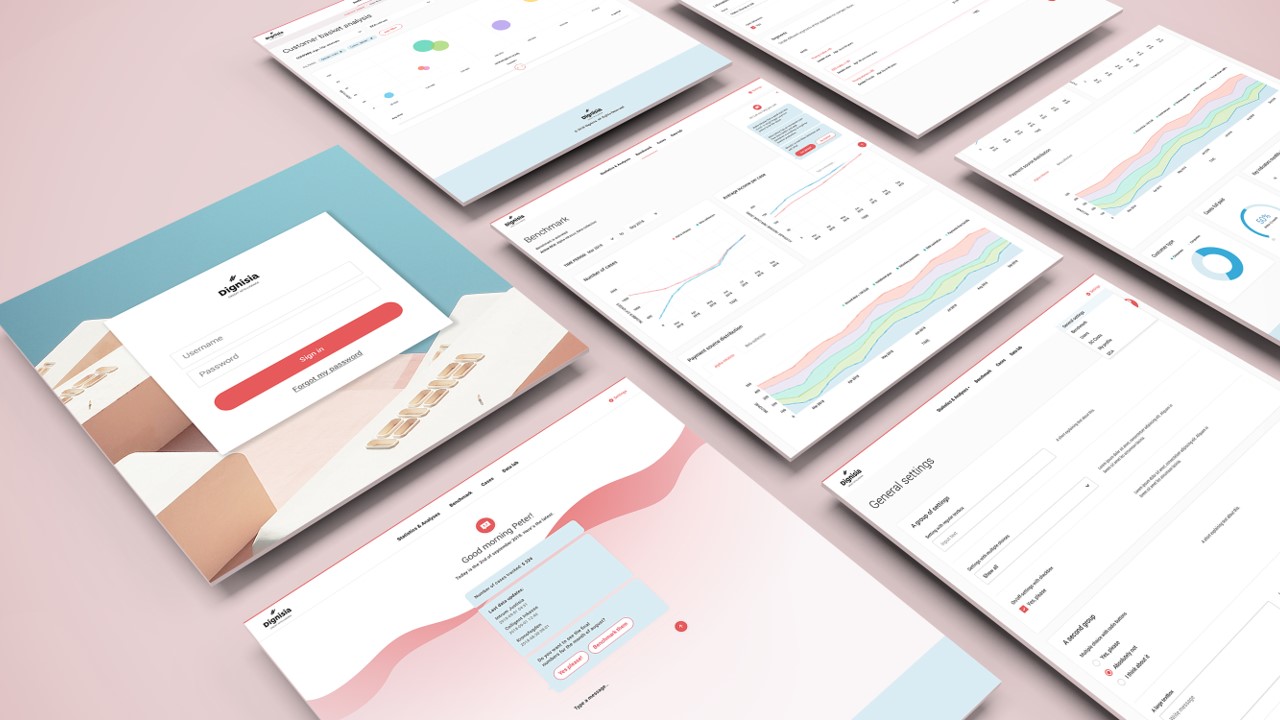

Zolva is the first to launch in Finland: Debt collection performance data is now transparent and up-to-date for creditors

Zolva's goal is to make the debt collection industry more transparent. Producing analyzed information for customers is an important step towards a transparent debt collection industry.

May 05

Changes to interest rate cap and Consumer Protection Act

The planned changes to the Consumer Protection Act and the interest rate cap have been confirmed on March 23. The changes will take effect on October 1.