Consumer loans under changing environment – The biggest change after a year

04 Apr 2023, 6:49 GMT

According to Mikko Eloranta, overindebtedness is a real problem that can lead to significant negative effects on the entire national economy.

The aim of the new legislation is to tackle consumers’ over-indebtedness. Credit institutions and the collection industry are already preparing for the upcoming changes.

The over-indebtedness of consumers is now wanted to be controlled by means of legislation. In the background, there is a negative cycle that has been going on for years, where the number of individuals who have defaulted on payments has increased.

According to Asiakastieto, more than 365,000 Finns have a payment default entry in their credit information, although the amendment to the Credit Information Act, that came into effect at the end of last year, removed almost 20,000 people from the register. The Bank of Finland’s database, on the other hand, reveals that the portfolio of unsecured consumer loans was 8.5 billion euros at the end of the year.

“Hopefully, the new guidelines for good collection practices will increase transparency and leave no room for interpretation. At Zolva we want to promote responsibility for the entire debt collection industry.”

MIKKO ELORANTA, HEAD OF LEGAL

Changes in legislation will also have an effect for secured and unsecured consumer credits and debt collection agencies. Collection company Zolva’s Head of Legal Mikko Eloranta lists the most important changes below.

Positive credit information register and interest rate cap

The usage of the positive credit information register in consumer lending will start on 1st of April 2024. The positive credit information register means that all lenders are obliged to report the credits taken by the consumer to a common register maintained by the authority. Credit register data can also be combined with income register data.

In the future, lenders will be aware of how much credit the consumer has to various financial institutions and what his or her ability to pay is in relation to the amount of credit.

– The register contains information on, among other things, on granted loans, loan principal, interest rates, payment delays for more than 60 days and information on debt recovery proceedings. This is a very positive thing. I strongly believe that a positive credit information register will decrease over-indebtedness. At the same time, it will reduce the credit losses for credit institutions, says Eloranta.

According to him, a positive credit information register should be introduced instead of lowering the interest rate ceiling. The planned amendment to the Consumer Protection Act will lower the maximum interest rate on consumer loans from the current 20 percent to 15 percent.

The law should enter into force later this year. In the government’s proposal, the transition period is six months.

– Especially in the current economic situation, it would make more sense to regulate lenders in a different way than with an interest rate cap. The danger is that when the price of money is high, granting unsecured credit becomes unprofitable. It affects consumers and the market negatively, Eloranta estimates.

Reducing the storage time of payment remarks

Payment remarks were wiped off all at once from thousands of those who received a payment remark, when the change in the Credit Information Act came into effect at the beginning of December.

In the future, the marking will be removed one month after the consumer has paid his or her debt and the debtor has reported the information to the credit information company. The aim of the law change is to encourage consumers to pay their debts regularly and to speed up the return to a “normal” situation.

The change in the law has an impact on us and our clients. We no longer receive information about the consumer’s previous payment behavior in the same way through payment remarks. This information is valuable if the person’s payment defaults have been frequent. And many of those who have received a notice of payment default have had problems with payments for a long time, says Eloranta.

Guidelines for good practice in debt collection

The Finnish Competition and Consumer Authority’s guidance on good debt collection practices in consumer debt collection is changing. The draft is currently in the opinion round.

According to Eloranta, the current guidelines are open to interpretation. The guidelines have been valid since 2014. Since then, for example, various digital payment methods have become more commonly used.

Because of the instructions have been open to different interpretations, some debt collection companies have unintentionally acted against the instructions.

Zolva in brief

- Perustettu 2021

- Previously know as Finans2 in Nordics

- Groups’ estimated revenues are 50 MEUR

- 650 employees

- Operations in Norway, Finland, Sweden, Denmark, Italy, Spain and Portugal

– One open to interpretation has been related to the fact that disputed receivables cannot be collected. At what stage can the debt collection company check whether the dispute is invalid and the debt collection can be continued? It cannot be the case that the debtor simply disputes a claim without any grounds. Hopefully, the new guidelines for good practice in debt collection will increase transparency and leave no room for interpretation. It has an impact on the industry’s reputation. At Zolva we want to promote responsibility for the entire debt collection industry, says Eloranta.

The activities of debt collection companies are regulated by the Debt Collection Act. The law states that collection may not use procedures contrary to good collection practices. The guidelines published by the Finnish Competition and Consumer Authority aim to set a framework for debt collection companies’ procedures. However, market law decides on the content of good debt collection practices.

Other actions

Less attention has been paid to the Omnibus Directive initiatited through EU, which has been incorporated into Finnish legislation through changes to the Consumer Protection Act. For example, regulation of distance sales have been tightened, and transparency has been added to online store discount campaigns and product reviews.

– The aim of the legislation is to improve the position and security of consumers. For example, a contract made over the phone will only be valid in the future if the consumer has accepted the contract in writing after the call, says Eloranta.

In addition, a pilot project is underway, the goal of which is to increase the purchasing power of debtors in the weakest position. Bailiffs’ Office has started a pilot project, where the protection share of the protected income has been increased by approximately 190 euros per month.

At the same time, the number of payment-free months for low-income people in Bailiffs’ Office will permanently change to three months. On special grounds, a debtor with a low income can also be granted a fourth payment free month. The change will take effect in May.

– The measures are understandable in this economic situation. The wish is that the real benefits are also investigated and analyzed thoroughly. Otherwise, the recovery from overdue debts will only be prolonged, Eloranta estimates.

NEWSLETTER

Nov 21

There are scam messages in Zolva’s name

Scam messages have been sent at least by e-mail and demand to pay the debt.

Aug 25

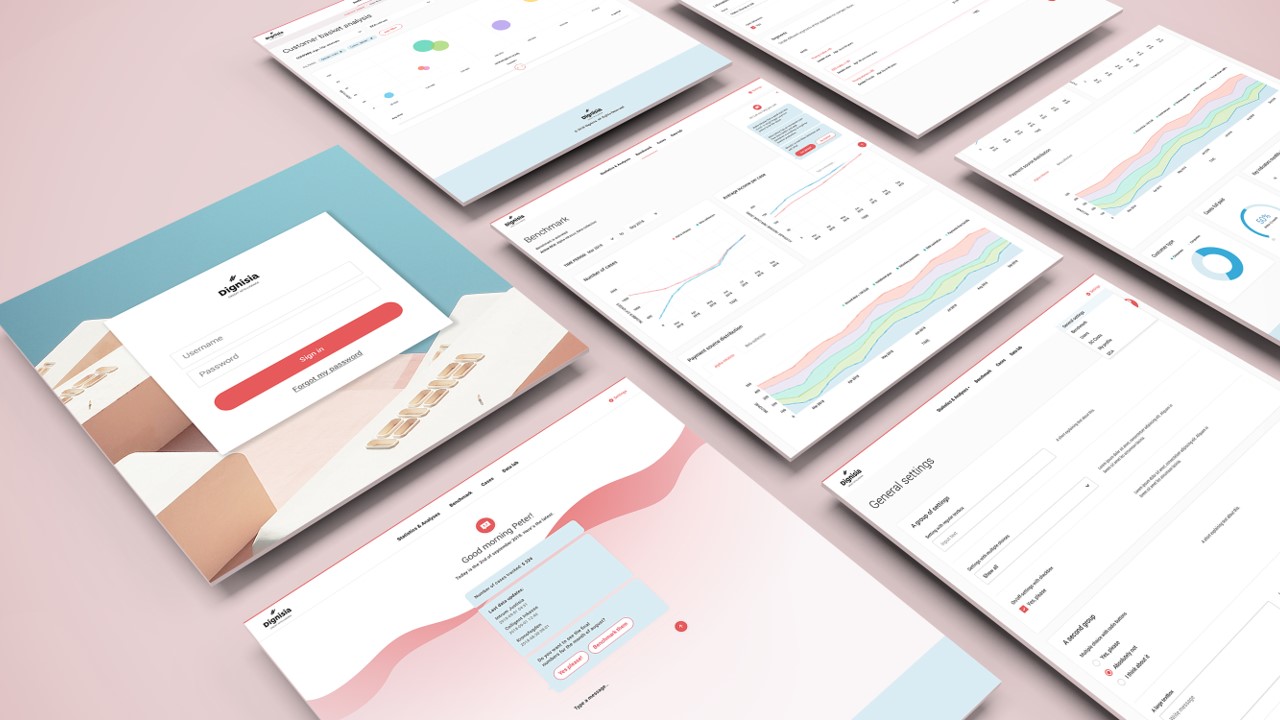

Zolva is the first to launch in Finland: Debt collection performance data is now transparent and up-to-date for creditors

Zolva's goal is to make the debt collection industry more transparent. Producing analyzed information for customers is an important step towards a transparent debt collection industry.

May 05

Changes to interest rate cap and Consumer Protection Act

The planned changes to the Consumer Protection Act and the interest rate cap have been confirmed on March 23. The changes will take effect on October 1.