Pulse of Finnish economy is now 62 – This is what it tells

04 Apr 2023, 7:31 GMT

Zolva's CFO-Barometer describes CFO's views on the economic development of large companies.

Debt collection agency Zolva’s first CFO-Barometer has been published. The answers of the CFO’s of Finland’s largest companies are highly fragmented.

Faith of CFO’s at Finland’s largest companies in the growth and profitability of will be tested in the coming months. As many as 40 percent of the CFO’s who responded to the debt collection agency Zolva’s CFO-Barometer predicts that growth and profitability will remain weak or modest in next three months.

“High inflation and consumer caution will certainly have a debilitating effect on the results of the pulse.”

LAURI KOSLOFF, TALOUSJOHTAJA

Taking into account all the answers, the economic pulse of companies remained at 62 points. The deviation in the answers was wide, as the lowest score was 20 points and the highest was 96. The maximum score was one hundred.

Zolva’s CFO Lauri Kosloff considers the large deviation in the answers surprising and worrying.

– In some companies, the results are indicating strongly deteriorating situation and even difficulties in terms of continuing business operations. The barometer produced by the Confederation of Finnish Industries also supports the view of companies’ low expectations. High inflation and consumer prudence will certainly have a debilitating effect on the results of the pulse. Financial decision-makers are generally a bit cautious in their estimates, especially regarding growth, says Kosloff.

The scoring of Zolva’s CFO-Barometers’ has been done in such a way that 0–10 points means the risk of going bankrupt. On the other hand, 11–30 points is weak, 31–49 points is to be below average, 50–75 points is satisfactory, 76–85 is good and more than 85 points is an excellent level.

Dividing into two groups in investments

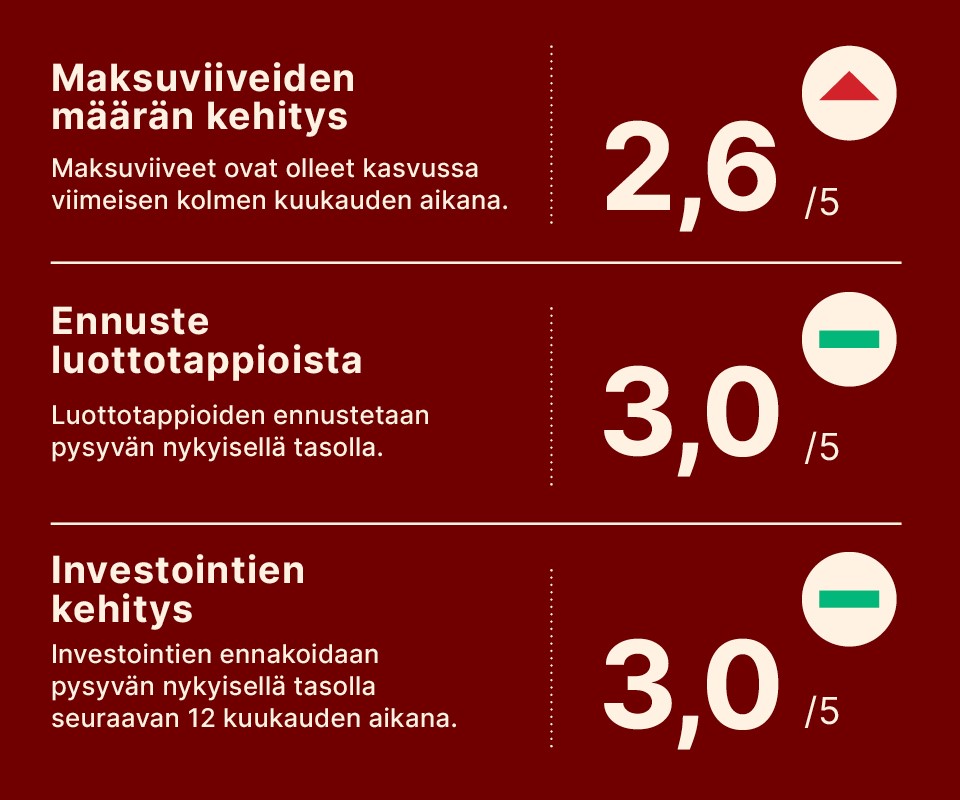

Financial managers were also asked about the development of payment delays during the previous three months, an estimate of the amount of credit losses and the companies’ willingness to invest in the next 12 months.

Based on the answers, customer payment delays have been somewhat increasing. At the same time, 30 percent of respondents predict that credit losses will increase in the coming months.

– For some companies, the development is worrying and certainly requires active risk management measures. On the other hand, the majority of respondents estimate that the situation will remain the same as now. It can be assumed that credit risk management is generally in good shape in Finnish companies, says Kosloff.

According to him, one interesting observation from the results of the CFO barometer is related to the willingness to invest and the wide dispersion of the answers. 40 percent of the respondents believe that investments will grow in the next 12 months. The same 40 percent disagree.

– The investment perspective for the upcoming year gives little hope for the recovery of the confidence of financial decision-makers. Uncertainty in the economy and the tightening of financial market have certainly also had a significant impact on the willingness to invest. It’s interesting to see which way the outlook turns as spring progresses, says Kosloff.

Zolva’s CFO barometer was carried out in February as an online survey. There were 33 respondents.

The next CFO-Barometer survey will be conducted in April and the results of the survey will be published in May.

Zolva in brief

- Founded in 2021

- Previously known as Finans2 in Nordics

- Groups’ estimated revenues are 50 MEUR

- 650 employees

- Operations in Norway, Finland, Sweden, Denmark, Italy, Spain and Portugal

NEWSLETTER

Nov 21

There are scam messages in Zolva’s name

Scam messages have been sent at least by e-mail and demand to pay the debt.

Aug 25

Zolva is the first to launch in Finland: Debt collection performance data is now transparent and up-to-date for creditors

Zolva's goal is to make the debt collection industry more transparent. Producing analyzed information for customers is an important step towards a transparent debt collection industry.

May 05

Changes to interest rate cap and Consumer Protection Act

The planned changes to the Consumer Protection Act and the interest rate cap have been confirmed on March 23. The changes will take effect on October 1.