Rapid growth in interest rates on unsecured consumer loans

05 May 2023, 5:32 GMT

Olli Jumeneff predicts that interest rates on unsecured loans will continue to rise.

The interest rate on new unsecured loans has risen rapidly to more than 11 percent on average. Zolva’s Olli Jumeneff encourages consumers to be careful with their finances.

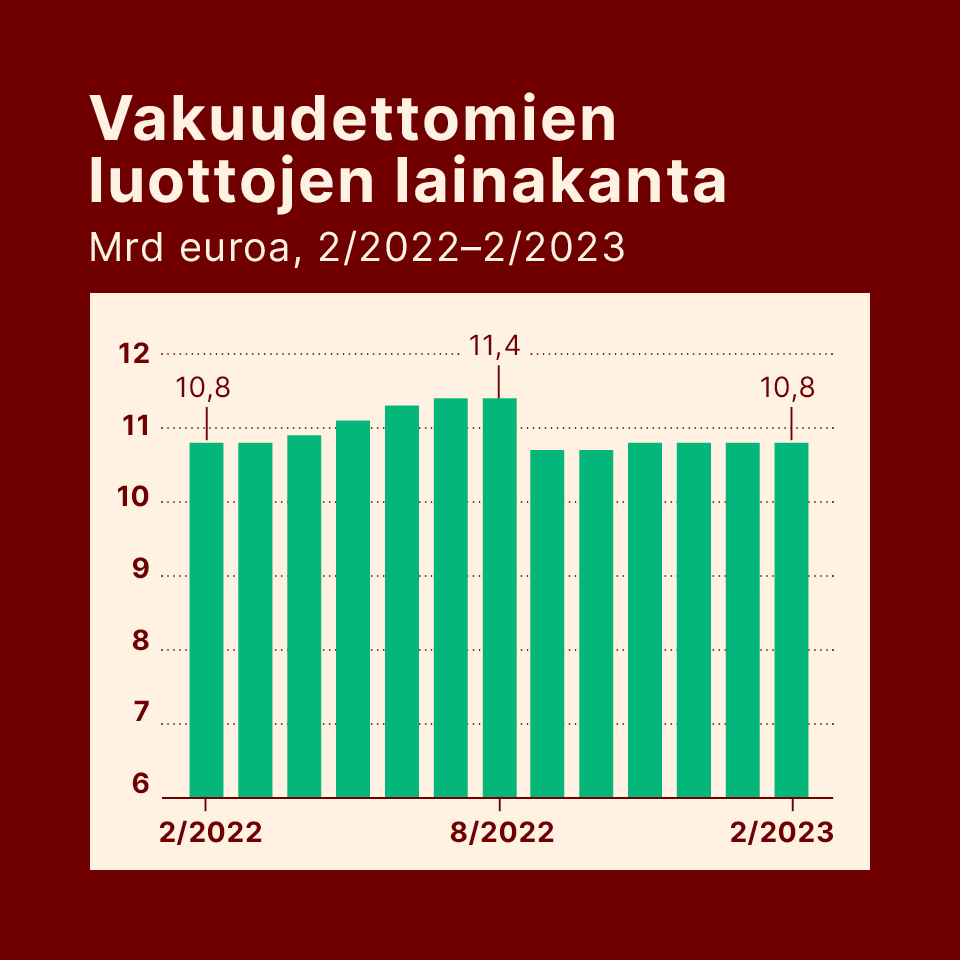

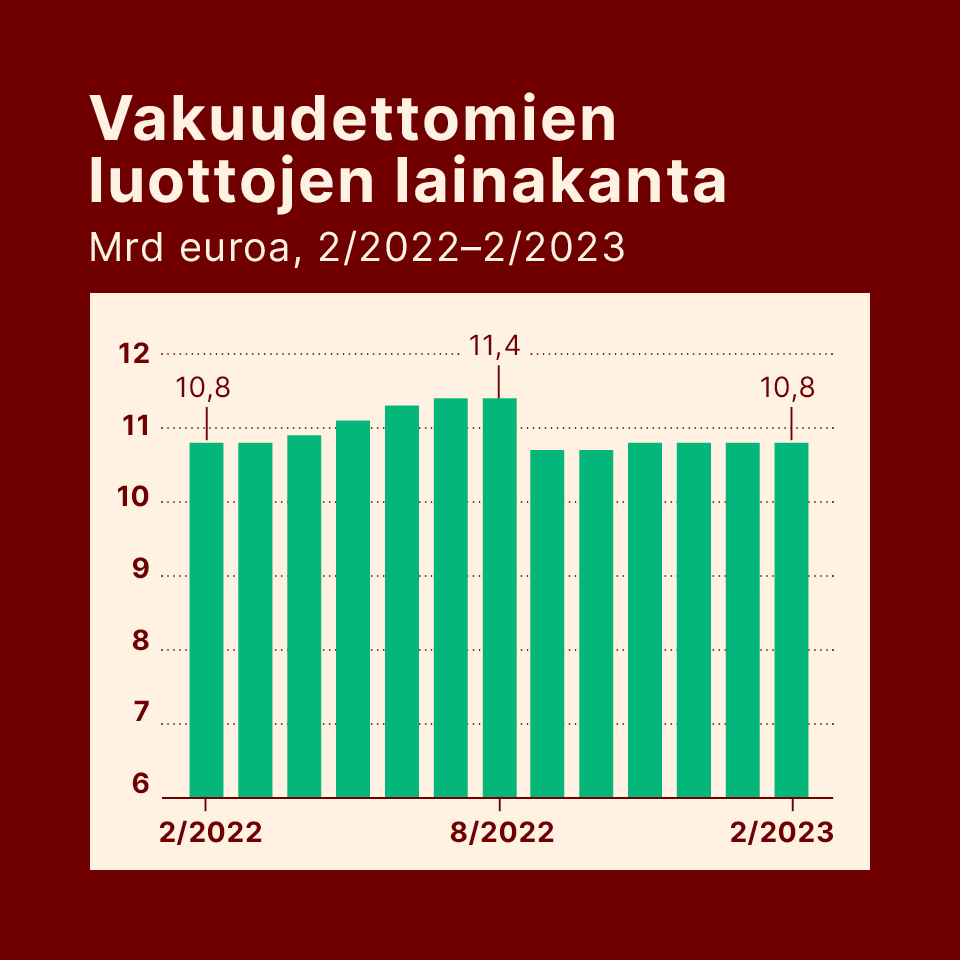

High inflation has reflected quickly in interest rates. The rise in interest rates can also be seen in unsecured consumer loans, in which loan portfolio in Finland is around 11 billion euros (February 2022, 11 billion euros). The unsecured loan portfolio of household consumer loans is about 8.5 billion (8.2), when loans related to the purchase of financing registered vehicles are removed from the figures.

According to Olli Jumeneff, Head of Sales of debt collection agency Zolva, the average interest rate on credit lines including credit cards and other unsecured consumer loans is currently around nine percent (6.6). Looking further down the line in the figures, the average interest rate on new consumer loans has already risen to 11 percent (8).

Jumeneff demands control from consumers in their consumption and personal economy. The danger is overindebtedness.

– Inflation drives up costs everywhere. The need for consumer loans increases if consumers do not have enough buffers in their personal economy.. The situation is also challenging for companies, as our latest CFO-Barometer shows. It is difficult for companies to pass on price increases in their entirety to customers, even though costs have risen significantly in a short time. It weakens profitability and affects employment rates, he says.

According to Asiakastieto, more than 365,000 (389,000) Finns have a payment defaults in their credit information, even though the amendment to the Credit Information Act that came into effect at the end of last year removed almost 20,000 people from the register.

Jumeneff predicts that the interest rate peak has not yet been seen.

– The European Central Bank’s increases in the reference interest rate do not alone explain the increase on unsecured consumer loan interest rates. Lenders also face cost pressures from elsewhere, and the rise in funding costs for lenders is greater than the rise in the reference interest rate. In that case, the costs cannot be transferred in their entirety to credit interests of consumer loans, he continues.

Legal changes to slow down overindebtedness

Unsecured consumer loans refer to loans for which no guarantee or other security has been given as collateral. Such loans are common, for example, in home renovations or home appliance purchases.

Several changes to the legislation are planned, the aim of which is to reduce over-indebtedness of consumers. They also affect the market for unsecured consumer loans.

Jumeneff says that the most significant measure in the fight against overindebtedness is a positive credit information register. Its utilization in lending will begin on April 1, 2024.

A positive credit information register means that all lenders are obliged to report the credits taken by the consumer to a common register maintained by the authority. Credit register data can be combined with income register data.

In the future, lenders will know how much credit the consumer has to various financial institutions and what his ability to pay is in relation to the amount of credit.

Jumeneff says that this increases transparency and helps responsible lending. I hope this means that the payment of previous credits with new credit will decrease, and through this, customers will have a better chance to settle their debts at the latest through collection or foreclosure, when the over-indebtedness can be stopped as early as possible.

In addition, there is an amendment to the Consumer Protection Act that will lower the maximum interest rate on consumer loans from the current 20 percent to 15 percent. The law enters into force on 1 October 2023.

– The change in the maximum interest rate will exclude some consumers from the market. However, with the current reference interest rate of the European Central Bank, we do not see a significant difference in the total interest paid by the consumer. Previous interest rate regulations have led to the fact that the average capital of loans has increased, when a higher return is desired from one customer. I don’t see this development as a good thing. I would hope that official reporting and published statistics would also take into account the average capital of loans, so that decision-makers can better monitor the development of the consumer credit market and the effects of various measures, says Jumeneff.

Zolva in brief

- Founded in 2021

- Previously known as Finans2 in Nordics

- Estimated revenues of the group are 50 MEUR

- 650 employees

- Operations in Norway, Finland, Sweden, Denmark, Italy, Spain and Portugal

NEWSLETTER

Nov 21

There are scam messages in Zolva’s name

Scam messages have been sent at least by e-mail and demand to pay the debt.

Aug 25

Zolva is the first to launch in Finland: Debt collection performance data is now transparent and up-to-date for creditors

Zolva's goal is to make the debt collection industry more transparent. Producing analyzed information for customers is an important step towards a transparent debt collection industry.

May 05

Changes to interest rate cap and Consumer Protection Act

The planned changes to the Consumer Protection Act and the interest rate cap have been confirmed on March 23. The changes will take effect on October 1.